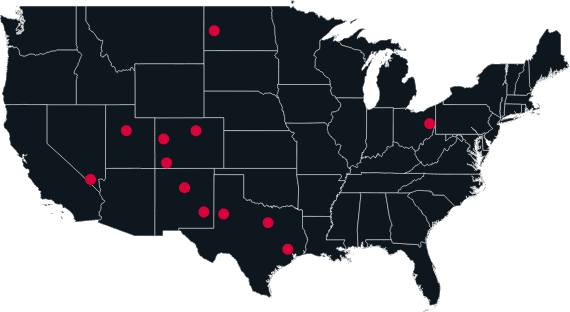

Locations

With branch locations in every time zone, Worldwide Machinery is ready to support your next job—wherever the work takes you.

Inventory

Worldwide Machinery has everything you need for your next project. We service the civil construction, pipeline, renewables, forestry, and mining sectors.

Why Worldwide?

One of the largest used equipment inventories in the world

Pro-rated overtime rates

Well-maintained late model equipment

The most qualified field service technicians in the region

Why Rent?

Lower Capital Expense

Purchasing heavy equipment often involves tying up capital for multiple years to come. Choosing to partner with an equipment rental company means freeing up cash that can be used to help grow your business and invest in other opportunities.

Predictable Costs

Renting heavy equipment provides contractors peace of mind because they are able to manage and expense their costs in a predictable way. Because Worldwide Machinery handles major repairs, construction companies aren’t faced with huge maintenance expenses (not resulting from damage).

Equipment & Service Where You Need It

A significant reason to consider renting is when you have jobs in multiple geographic locations. Depending on the job, it can be cost prohibitive to transport equipment across the United States. Likewise, renting equipment also means you gain access to our local Service Department should you need assistance.

Access To a Large Variety of Equipment

We get it. Not every piece of equipment makes sense to own. Partnering with a heavy machinery company is a great way to gain access to a diverse fleet of equipment. This means the ability to pursue a variety of jobs or temporarily increase your availability to operate multiple jobs at once.

Build Equity & Try Before You Buy

Rental Purchase Options are a great way to apply a portion of your rental to the purchase price of your machine. This gives contractors the opportunity to try out the equipment they are looking at purchasing and lower their purchase cost by applying rental payments to their purchase price.

Worldwide Rental Services was created by Worldwide Machinery in 1997 to serve contractors in the Rocky Mountain West. For many years, Worldwide Machinery had been working heavily in the cross country pipeline business both domestically and internationally, and decided that the markets in the West were underserved for heavy civil, highway and utility contractors.

Therefore, Denver, Colorado was selected for the first Worldwide Rental Services location with a small fleet that numbered 30 machines. Since that time, WRS has grown to more than 600 machines working in seven states. With locations currently in Salt Lake City, UT; Albuquerque, NM; Grand Junction, CO; Casper, WY; Las Vegas, NV; Dickinson, ND; Lubbock, TX; Fort Worth, TX; as well as the first one in Denver; WRS is positioned to support the contracting community with medium to large earthmoving rental equipment.

In addition to our fast service times, Worldwide Rental Services prides itself in the quality equipment that we offer. We continue to purchase new or late model equipment with low hours--this helps our customers get the latest most productive machines on the market, and minimizes downtime. We pride ourselves on being a first-class machinery rental company and are constantly seeking better solutions for our customers. In addition to providing high quality Caterpillar rental equipment, we are able to provide other brands like, John Deere and Komatsu; we are also an authorized dealer of K-tec pull type scrapers, and Tatu Discs.

We are passionate about our company culture of success, diligence, accountability, and teamwork. As a result, we hire and retain the best employees in the industry. Our employees believe as we do that great customer service is imperative for long term, repeat business. Worldwide Rental Services continually seeks to invest in and improve our staff so that we can better serve you.